For

those reading the blog or subscribing to the service that are not Secret

Betting Club (SBC) members, one of the things I did last season was construct

10 example portfolios of TFA bets that I tracked every month in the SBC forum.

The main reason for doing this was that I wanted to highlight to SBC forum

readers that:

- TFA

provides subscribers with the ability to achieve a decent level of return on

capital from the service due to the sheer number of systems available to follow

- Constructing

a TFA portfolio isn’t that difficult and anyone can do it

- Turnover

is much more important than ROI when it comes to achieving a decent return on

capital for a betting portfolio

- Lastly,

I hoped to be able to demonstrate that no matter how you followed the service

last season, you should have been able to make a profit

Of

course, as regular blog readers will be aware, last season didn’t exactly go to

plan for TFA and for the first season since inception, some systems had a

losing season. This had a knock-on effect on these portfolios and therefore,

for the low turnover portfolios, the season was a real struggle.

The

purpose of this post is to provide a quick overview of how the season went

generally for the portfolios and for the first time, to share which systems

were part of each portfolio. I didn’t share the systems which made up the

portfolios with the SBC forum members although of course, I shared the systems

with Peter Ling of the SBC. The purpose of the forum thread wasn’t to get

people to follow the bets, it was to show how powerful (or not!) a portfolio

approach could be with TFA.

There

has been a lot of talk last season on this blog and other blogs about whether

or not a portfolio approach is an appropriate way to follow the TFA systems.

I’ve always made my feelings well known on the subject and for me personally,

this is the way that I like to follow the systems. For me, the 3 main

benefits of a portfolio approach are:

- Diversification

– You are not putting all your eggs in one basket by following one system, one

algorithm or one type of bets

- Leverage

– You can make your betting bank work harder for you. For example, a system may

need a 50pt bank and yet, 3 systems combined may need a 100pt bank.

- Increased

Returns – This is linked to leverage I think but if you are following multiple

systems from a combined betting bank, there is potential to increase your

return on capital

I

think after the first 3 seasons following the systems this way, I honestly believed

that if you followed a decent number of systems in a portfolio, you couldn’t

lose following TFA. Of course, this was based on the premise that every system

would be profitable every season and the more bets you followed, the more money

you made and therefore, TFA was the greatest thing since sliced bread.

Roll

on 12 months and not surprisingly, my views are not as strong as they were last

Summer. I still believe TFA to be the greatest thing since sliced bread but I

now appreciate that a losing season for a system is not as remote a possibility

as I thought previously. Therefore, if a system can have a losing season, a

portfolio with a number of losing systems can have a losing season and

therefore, the TFA portfolio approach is not as infallible as I thought it was.

However,

I do think if you follow some basic rules about building a portfolio, it is

still a decent method but like any betting method, if you don’t put enough

thought into it or don’t appreciate the risks fully, it can go wrong.

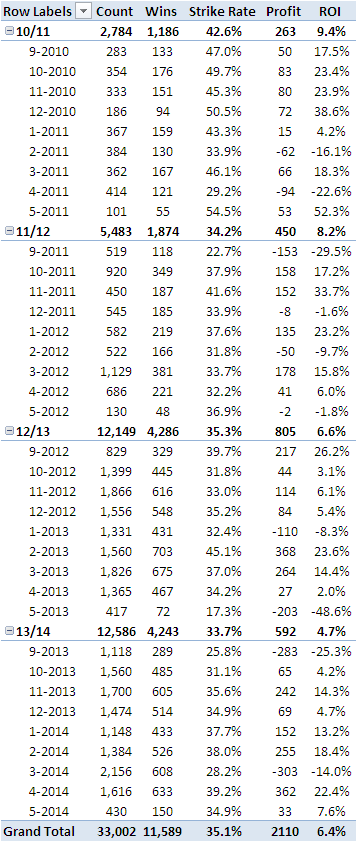

OK,

so here are the overall results for the season for the 10 portfolios I tracked

in the SBC forum last season:

I

think the first point to make is that only 7 of the 10 portfolios managed to

make a positive return last season. This alone is disappointing to me but I

think when you see which portfolios lost money, we can probably learn from this

experience. The 3 lowest turnover portfolios lost money last season as

quite simply, they didn’t have enough bets. If you rely on 3 systems, you aren’t

actually getting that much diversification at all and as I’ll discuss below

when I look at each portfolio in more detail, there was not enough

diversification in these lower turnover portfolios at all. Hence, they were

probably not much better than just following a single system and as I said

above, a single system can make a loss over a season.

I

think the other thing that jumps off the page here is the months of Sep-13 and

Mar-14. Anyone following the blog last season as well as those following the

system bets themselves will be aware of the difficulties the systems had in

both these months generally as the underlying results were very tough and we

can see that impact magnified to a degree here as we’re looking at combinations

of systems. Obviously, both of these months were a bit of a nightmare but I

think it’s interesting that even during a really poor season for the systems

and a tough season generally for football betting, 7 of the portfolios achieved

a profit.

I

guess the other point I’d make is that even though 3 portfolios lost money, the

losses were very small. The worst system lost 11.2% of its betting bank over

the season. The lowest ROC for a profitable portfolio was 25.9%. The average

ROC for a losing portfolio was 8%, the average ROC for a winning portfolio was

59.6%.

I

think the other point worth making is the ROI. I came up with the phrase a few

years ago ‘ROI for show, ROC for dough’ and I think we can again see this in

play here. Portfolio 1 managed to make an ROI of 5.3% which for some people,

may not seem like a decent ROI for football systems but when you see this is

achieved across 2,157 bets, it suddenly doesn’t appear too bad as the ROC is

91.6%. A bank growth of 91.6% for a really poor season and the worst

season of the 4 so far doesn’t look too bad now does it?

OK,

I’ll quickly run through each portfolio and comment on the individual system

results in each portfolio and the overall returns for the portfolio.

Portfolio

1

This

portfolio contains 7 systems and the portfolio is fairly well diversified. It

contains 3 Est Systems (21,7-21 and 8-22), 1 New System (31), 1 Misc System

(STOY), 1 Draw System (D1-D6) and 1 Euro System (E2-E7).

With

hindsight, I’m not sure what system 7-21 and 8-22 bring to the portfolio apart

from extra correlation as the bets will already appear on system 21. I would

probably throw in a European Draw system next season and remove 7-21 and 8-22

if I was adjusting this portfolio next season.

In

terms of results, here’s the results by system:

21

= 11.9pts

7-21

= -16.8pts

8-22

= -9.1pts

31

= 56.9pts

STOY

= 21.4pts

D1-D6

= 44pts

E2-E7

= 6.2pts

Overall,

a profit of 114.5pts, an ROI of 5.3% and a ROC of 91.6%.

On

one hand, I’m disappointed with the results as based on historical results, I

would have expected a higher level of ROC. However, considering how tough the

season was and the fact this is the toughest of the 4 seasons to date, I don’t

think I can moan too much about the level of returns. With hindsight, I’m not

even sure what systems 7-21 and 8-22 are doing in the portfolio as they don’t

bring any additional diversification and as luck would have it, these two

systems are the ones pulling down the performance of the portfolio.

Portfolio

2

This

portfolio contains 7 systems and the portfolio is again fairly well

diversified. It contains 3 Est Systems (21,6-21 and 7-22), 1 New System

(31-41), 1 Misc System (STOZ), 1 Draw System (D2-D6) and 1 Euro System

(E2-E6).

Similar

comments to portfolio 1 really as I’m not sure why we need 6-21 and 7-22 in the

portfolio. I would keep either 21 or 6-21 and bring in a new European Draw

system to replace the lost turnover.

Here’s

the results by system:

21

= 11.9pts

6-21

= 12pts

7-22

= -11pts

31-41

= 41.9pts

STOZ

= 8.8pts

D2-D6

= 36.3pts

E2-E6

= 13.9pts

Overall,

a profit of 113.9pts, an ROI of 5% and a ROC of 75.9%.

Only

the one losing system in this portfolio and again, it is probably one system

that shouldn’t even be in there. I think a few key systems in here had a below

par season (21 and STOZ) and during a more normal season, the returns would

have been better I think. Even so, a 75.9% ROC is not too bad during a really

tough season.

Portfolio

3

This

portfolio contains 7 systems and the portfolio is again fairly well diversified

although there were no Euro bets in this portfolio. It contains 2 Est Systems

(6-21 and 8-22), 2 New Systems (31,33-41), 2 Misc Systems (STOY, TOX), 1 Draw

System (D3-D7).

With

hindsight, I would replace either STOY or TOX with another Misc System (6-32

probably) or replace it with a Euro system. I would also bring in a Euro Draw

system.

Here’s

the results by system:

6-21

= 12pts

8-22

= -9.1pts

31

= 56.9pts

33-41

= -10.1pts

STOY

= 21.4pts

TOX

= 11.5pts

D3-D7

= 1.7pts

Overall,

a profit of 84.5pts, an ROI of 4.4% and a ROC of 56.3%.

2

losing systems, a poor selection of a draw system and an under performance of

6-21 and TOX and yet, the portfolio made 56.3% ROC. I think this is as good an

advert for a portfolio approach as you can get! Lots of mistakes made in the

selection of the systems but at the end of the day, we will never choose the

correct systems. I think with a portfolio approach though, you can limit the

damage by having more systems in there or in the case of this portfolio, you

can actually still achieve a good return during a horrible season!

I

would probably remove STOY or TOX and include a Euro System and maybe throw in

a Euro Draw system too.

Portfolio

4

This

portfolio contains 6 systems and the portfolio is less well diversified as

there are no Draw or Euro bets included. It contains 2 Est Systems (6-21 and

8-22), 1 New System (31-41) and 3 Misc System (STOY, STOZ and 6-21-31)

My

thinking when I built this portfolio was to concentrate solely on the UK bets

and put an emphasis on the Misc systems. The first 3 portfolios had more

emphasis on the Est and New Systems. Looking at it again, I would probably only

keep STOY or STOZ and of course, with no Euro or Draw bets, there is plenty of

room for more diversification and turnover if wanted.

Here’s

the results:

6-21

= 12pts

8-22

= -9.1pts

31-41

= 41.9pts

STOY

= 21.4pts

STOZ

= 8.8pts

6-21-31

= 25.4pts

Overall,

100.4pts profit, an ROI of 4.7% and a ROC of 66.9%.

Only

one losing system in here but it’s a fairly strong performance from this

portfolio. With hindsight, having STOX and STOY in there probably doesn’t make

sense and with hindsight, having seen the returns of the top 3 portfolios, I’m

definitely favouring the route of more diversification across other bets (Draws

and Euros) but for a UK specific portfolio, this one isn’t too bad.

Portfolio

5

This

portfolio contains 6 systems and the portfolio is slightly more diversified

than portfolio 4 but there are no Euro bets included. It contains 2 Est Systems

(21 and 7-21), 1 New System (31-42 and 33-42), 1 Misc System (STOZ) and 1 Draw

system (D2-D7)

This

is the first portfolio with a much lower turnover as some of the systems are

getting to be more selective. Again, it’s easy with hindsight to say I’d change

systems but I think for the purpose, this portfolio is OK.

Here’s

the results:

21

= 11.9pts

7-21

= -16.8pts

31-42

= 4.2pts

33-42

= -9pts

STOZ

= 8.8pts

D2-D7

= 39.8pts

Overall,

38.9pts profit, an ROI of 2.6% and a ROC of 25.9%.

With

2 losing systems, 2 systems which performed poorly and one system below par,

it’s amazing any profit was made at all here, never mind a 25.9% ROC! You make

your own luck at times and I guess by including an unproven Draw system in

here, this made this portfolio last season. All of the profits came from the

Draw system which going into the season, had no live results!

A

really poor performance from this portfolio but if this can happen during a

poor season, it can only get better I suspect!

Portfolio

6

This

portfolio only contained 5 systems but I would say it was fully diversified

unlike a few of the previous portfolios. It contains 1 Est System (6-21), 1 New

System (31-42), 1 Misc System (STOY), 1 Draw System (D2-D6) and 1 Euro System

(E3-E7).

I

like this portfolio. I liked the idea of one system from each group of systems

although I’d probably switch 31-42 for 31-41 and I’d probably switch the draw

system to D1-D6 and bring in a new Euro Draw system too in future.

Here’s

the results:

6-21

= 12pts

31-42

= 4.2pts

STOY

= 21.4pts

D2-D6

= 36.3pts

E3-E7

= 5.1pts

Overall,

79.1pts profit, 6.3% ROI and a ROC of 63.3%.

I

like this portfolio idea. I like the way the risk is spread evenly across all

systems although as always, it is probably taking a bit of a chance with

putting equal weight on the Euro and Draw systems given their lack of live bets

thus far but again, it worked out fine.

Portfolio

7

This

portfolio only contained 5 systems and it was fairly well diversified (No Euro

Systems) although we are now into the portfolios that had lower turnover. It

contains 1 Est System (6-21), 1 New System (32-41), 2 Misc Systems (21-31,

STOZ) and 1 Draw System (D3-D7).

Here’s

the results:

6-21

= 12pts

32-41

= -0.7pts

21-31

= 24.4pts

STOZ

= 8.8pts

D3-D7

= 1.7pts

Overall,

46.3pts profit, 3.1% ROI and a ROC of 37%.

This

portfolio struggled a little with system choice. 32-41 rather than 31-41 dented

profits massively, D3-D7 rather than of the other first 4 combined draw systems

(D1-D6 thru to D2-D7) dented profits massively and STOZ was poor in comparison

to TOX and STOY.

Again

though, difficult to be too critical of a portfolio that makes 37% ROC during a

really poor season for the systems in general.

Portfolio

8

This

portfolio only contained 4 systems and 3 of the systems were more of the

selective systems amongst the combined systems. Hence, given the issues we had

with filtering the system bets, these portfolios are going to struggle last

season.

The

4 systems were 1 Est System (7-21), 1 New System (33-41), 1 Misc System (STOY)

and 1 Draw System (D3-D7)

The

results were:

7-21

= -16.8pts

33-41

= -10.1pts

STOY

= 21.4pts

D3-D7

= 1.7pts

Overall,

-3.8pts, -0.7% ROI and -4.8% ROC.

When

50% of the portfolio contains the worst Est System and the worst New System

(not easy to do considering there were 66 possible pairs of these systems!), it

is unlikely to be a good season!

With

hindsight, following a lower number of systems in a portfolio isn’t the worst

idea in the world but following very selective systems in a portfolio opens up

the door to variance as you don’t have enough turnover to overcome the

variance.

My

own view is that if you are following a portfolio approach, you need to ensure

you have enough unique bets to make it worthwhile. This portfolio along with

the other two losing portfolios didn’t have enough bets last season IMO.

Portfolio

9

This

portfolio only contained 3 systems these were more of the selective systems

amongst the combined systems. Hence, given the issues we had with filtering the

system bets, these portfolios are going to struggle last season.

The

systems were 1 Est System (7-21), 1 New System (32-42) and 1 Misc System (TOX).

The

results were:

7-21

= -16.8pts

32-42

= -2.7pts

TOX

= 11.5pts

Overall,

-8pts, -1.3% ROI and -8% ROC.

Again,

when 2/3 of the portfolio contain losing systems, you can’t expect to have a

winning season! Not enough bets and not enough systems.

Portfolio

10

This

portfolio only contained 3 systems these were more of the selective systems

amongst the combined systems. Hence, given the issues we had with filtering the

system bets, these portfolios are going to struggle last season.

The

systems were 1 Est System (7-22), 1 New System (33-42) and 1 Misc System

(STOZ).

The

results were:

7-22

= -11pts

33-42

= -9pts

STOZ

= 8.8pts

Overall,

-11.2pts, -2.2% ROI and -11.2% ROC.

I

think after writing the above reviews, there are some additional points I would

add when building a portfolio approach to following the TFA systems:

- Think

about what each system brings to your portfolio. Don’t just add systems for the

sake of adding systems. If it doesn’t bring you diversification, leverage or

increased returns, don’t add the system!

- Following

3 or 4 correlated systems in a portfolio with a very low overall turnover of

unique bets is not a portfolio approach at all and is no better than following

one system (and is probably worse!)

- To

benefit from a portfolio approach, you need to follow a decent number of

systems and of course, the more diversification you have, the better

Hopefully

this post gives a good case for following a portfolio approach to TFA but as

always, if used incorrectly, it can go badly wrong I think!