Now, before I get onto this, a few caveats.

This is only one idea of a portfolio. With 20 individual systems this season and 2 ways to play each systems (H/A and DNB), that means there are 40 possible systems. Depending on how many systems you want to play, there are clearly millions of different combinations of portfolios. Throw in the fact that I'm playing higher stakes on homes than aways in one of my portfolios and you can see that the number of portfolios is infinite.

Clearly, there is absolutely nothing to say that this portfolio is any better than any other portfolio. I haven't tried to find a portfolio that works historically and decided I'm going to use this. I've decided which systems I want to follow based on historical results, decided how to follow the systems to suit my risk aversion and simply, combined these systems to form a portfolio. I'm not suggesting for one minute that this is an optimal way to create a portfolio. It's how I've created my portfolio and nothing more.

Last but not least, past performance can only ever be an indicative guide of the future performance.

OK, caveats out the way, how do the results look?

Well, I'm quite pleased with how the portfolio shapes up historically. This table shows the results by season for both portfolios. Portfolio one is based on the systems from last season and portfolio two is based on the new systems from next season.

As you can see, I've dropped the first two season's from these results. I personally don't place a lot of weight on the performance of my systems in the 06/07 and 07/08 seasons. I know there is some backfitted results included and therefore, to help set my expectations, I always ignore any season's which contain backfitted results.

The first thing that stands out is the fact that I'm playing far fewer bets in portfolio two. This is how I wanted it to look as these bets are much more unproven and therefore, I don't want to get to the stage whereby my established systems make me money and my new systems lose me all of this money.

I mentioned in my last post that I would play lower stakes on the portfolio two bets but I'm not sure I need to now I've looked at the number of bets. I basically wanted portfolio one to carry around 2/3 of the risk next season and by playing 1pt on each bet in both portfolios, this can be achieved.

Interestingly, portfolio two did better than portfolio one last season but I can put that down to the fact portfolio two used DNB much more last season. Portfolio one only uses DNB on aways priced 5/2 or greater.

The next interesting thing to look at is the results on a monthly basis.

As I also said in my last post, I was keen to see how bad portfolio one did during February and April as the systems had a nightmare in both months. As you can see, portfolio one had a nightmare in both months too. After winning an average of 50pts for the first 4 months of the season, the portfolio lost 27pts in February and another 51pts in April. OUCH!

On the bright side though, they won all of February's losses in March and they did rebound a little in May too. However, I can't get away from the fact the portfolio made no profit in the 4 months from Jan-11.

Interestingly, portfolio two didn't suffer anywhere near as badly. This portfolio suffered a loss in December and a small loss in February but somehow, the portfolio managed to dodge the substantial loss created by the established systems in April. Why is this? Simply, the second portfolio uses a lot more DNB betting and therefore, when we suffer from an obscene number of draws as we did in April, the portfolio doesn't suffer nearly as much. Or in this case, it can even make a profit when there are a lot of draws!

However, in the first 4 months of last season, portfolio two did nowhere near as well as portfolio one, so it has to be kept in perspective.

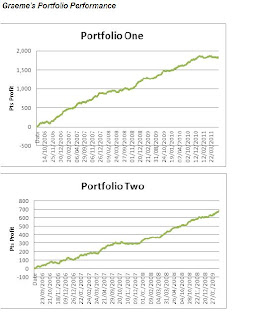

For those that prefer pictures.....

I think these pictures paint an interesting picture. People can rightly point to portfolio one and the fact it has made very little profit over the last 5 months of trading. However, I find it quite reassuring that portfolio two suffered a near identical 5 month spell during the 07/08 season and yet, the portfolio has bounced back over the last couple of seasons.

Clearly, looking at the graphs, you could argue that portfolio two should maybe carry more confidence but then again, I know portfolio one has been there and done it last season whereas portfolio two is all about backtested results and it has no real life experience yet!

I hope the above gives a little insight into how my own plans are shaping up for next season. Not long to go until we get to the first bets of the season now........(just another 6 weeks!)

On paper,this looks great but do you seriously think you can do as well next season?no, thought not.i'll be following with interest.

ReplyDeleteHi there I'm Anon from your last post. just like to say that I have finished reading your last blog.

ReplyDeleteI look forward to reading this one though it will be at home, so I won't be able to devour it quite so quick (takes ages to load on my phone).

I must say I enjoy your style and brutal honesty in your writing.

GL

James

Hi Anon 1.

ReplyDeleteI thought twice about publishing this (tend to just delete rubbish comments!) but I think you actually deserve a decent reply as it's a fair comment. Do I think I can achieve these returns next season? I'll do a post on it later this week.

Cheers,

Graeme

Hi Anon 2 (James).

ReplyDeleteYeah, good luck with reading the blog on your phone mate. Wouldn't fancy that task myself going by the size of some of the posts! :)

Thanks for reading.

Graeme